Xiaoba Yiyanjia | Manchester United Financial Report Analysis: Losing for 6 years in a row, and the record revenue of 660 million cannot hide the crisis

Although Manchester United hit a record high in revenue last season, it still lost for the sixth consecutive year. Ratcliffe has implemented cost cuts, but huge transfer expenses coexist with ongoing debt pressure, and the road to revival is full of challenges. The Athletic author Mark Critchley and Chris Weatherspoon conducted a detailed analysis.

Although Manchester United missed the Champions League last season and still hit a record high in the club's historical revenue, at the same time, they have also failed to make a profit for the sixth consecutive year, revealing a continuous divergence between competitive performance and financial health.

The latest financial report for fiscal year 24/25 showed that Manchester United's total revenue reached 666.5 million pounds, mainly due to the significant increase in game-day revenue and business revenue. Among them, the game-day revenue hit a new high of 160.3 million pounds for England's teams, and the commercial revenue also increased to 333.3 million pounds, successfully buffering the decline in broadcast revenue caused by the absence of the Champions League.

Nevertheless, the club recorded a loss of £33 million for the fiscal year. Although the deficit of £113.2 million narrowed from the previous fiscal year, this is the sixth consecutive year that Manchester United is in a loss state.

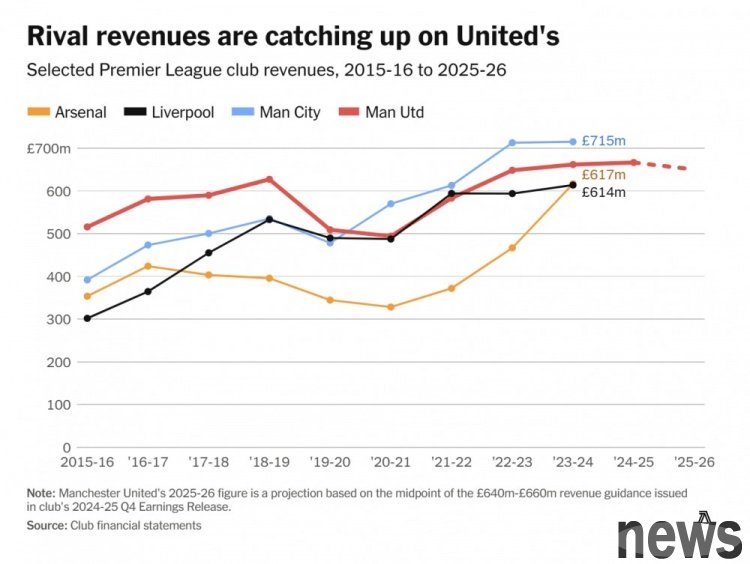

What is more worthy of attention is that despite last season's revenue breaking record, Manchester United expects revenue to decline this season in the announcement, with revenue expected to be between 640 million and 660 million pounds in fiscal 25/26. This will be the first time the club has missed the European competition in more than ten years, and the expected revenue decline is even lower than the revenue that may be brought by participating in the UEFA Cup, indicating that the club has included other business growth in the calculation basis.

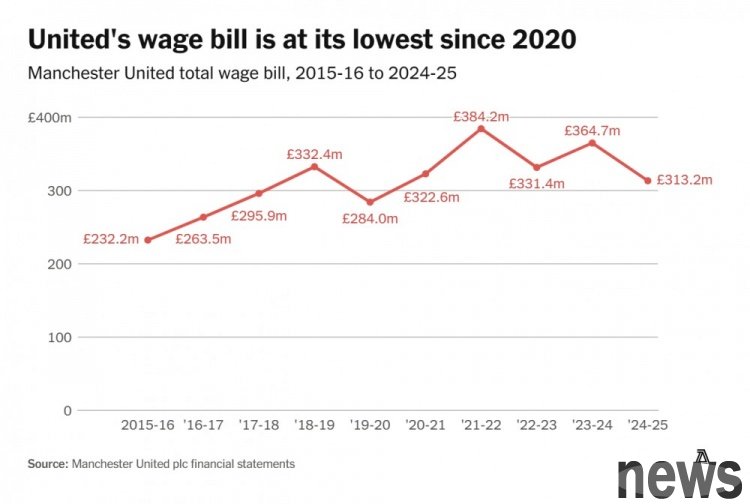

Since Ratcliff took over football operations from the Glazer family, he has implemented a series of cost-cutting measures to reverse the financial situation. A layoff and restructuring plan involving up to 450 positions, coupled with the lack of bonuses caused by missing the Champions League, has collectively reduced Manchester United's salary expenditure to £313.2 million, the lowest level since the 19/20 season.

However, the club has taken a high price for a series of operational decisions: the firing of coach Ten Hach and his team cost £10.4 million, which just triggered its contract renewal terms four months ago; sports director Ashworth was fired just five months after taking office, incurring another £4.1 million in spending. The cost of these special projects totaled £36.6 million.

Ratcliffe even warned that if operating costs are not strictly controlled, Manchester United may face the risk of "financial exhaustion" before Christmas. Although he injected £80 million at the beginning of the year, the club's cash reserves were only £86.1 million by the end of June.

What is even more worrying is Manchester United's continued high investment and low returns in the transfer market. The club paid £279 million in cash on player transfers last season, nearly £60 million higher than the original record in the 19/20 season. Ratcliff admitted in an interview with the BBC: "We are not signing new players this summer, but are continuing to pay transfer fees for Anthony, Casemiro, Onana, Hoylen and Sancho." At the same time, Manchester United's total debt has reached £637 million, up from £546.6 million last year, in part due to net borrowing of £130 million from revolving credit this fiscal year. The club may use credit lines again this summer to support transfer operations, which means debt levels may rise further. Manchester United's pre-tax loss last season was £39.7 million, a figure that will also become the benchmark for the Premier League's Profit and Sustainable Development Rules (PSR). However, it should be noted that Manchester United's PSR accounting is based on the accounts of its subsidiary Red Football Limited, rather than listed entities.

The "tug-of-war" between cost reduction and decision-making mistakes

Manchester United can still set a new revenue record without losing to the Champions League, once again confirming its strong business heritage. Even as broadcast revenue dropped by £48.8 million, the total revenue of £666.5 million still ranks the third highest in English football club history - only Manchester City had surpassed this figure in the 22/23 and 23/24 seasons.

But behind the glory is a crisis. As other giants have not released fiscal year data, Manchester United's revenue ranking may drop to at least third, and even be overtaken by Arsenal to fourth. Liverpool and Manchester City are expected to both break through the £700 million mark.

From the 15/1 season to the present, compared with the Premier League opponents, if the prediction comes true, this will be the first time that Manchester United's revenue has fallen out of the top three in the Premier League era, and it is only the second time that it is not in the top two. What is more worthy of attention is that in the 25/26 season, Manchester United expected revenue to stagnate or even decline, reflecting that poor competitive performance is causing the club to be financially surpassed by multiple opponents. Highlights such as 10% increase in business revenue and match-day revenue hit England's record (160.3 million pounds, an increase of 17% over the previous fiscal year), just contrasting the negative impact of missing the European war. Manchester United's average daily income in home games last season was £5.3 million, down from 5.5 million in the previous year, but it has achieved a 29% increase in ticket prices since the 22/23 season.

Manchester United's wage level is at its lowest level since 2020

Since Ratcliff took over in February 2024, layoffs have become the main line of club operations. Although the reduction in wage expenditure by £51.5 million (14%) reflects the effectiveness of the layoff plan, it is also directly related to the absence of the Champions League bonus, and the decline is actually less than the salary reduction when missing the Champions League season in the 22/23 season.

What is really worrying is the frequent decision-making mistakes that the club has made. Tenhah and his team spent £10.4 million, and their contract renewal terms were activated four months ago; Ashworth was fired after five months of office incurred another £4.1 million – such high aftermath expenses are constantly offsetting the benefits of cost reductions.

Players' amortization cost has increased to more than £190 million, reflecting Manchester United's continued spending in the transfer market, with Chelsea only reaching this level in English football. Although the complete figures of transfer debt are yet to be disclosed, the transfer cash expenditure of £279 million in the 24/25 season has clearly shown a huge capital expenditure.

Unlike Chelsea and Manchester City, Manchester United has extremely limited funds recovered through players' sales. Net transfer cash expenditure reached 230 million pounds, and the total net outflow in the past five years has increased to 685.5 million pounds, highlighting the club's structural shortcomings in player trading strategies. In terms of financial debt, although positive exchange rate changes have reduced the book value of US$650 million in long-term debt, the total debt in pounds is still rising compared with a year ago, due to the use of revolving credit in fiscal 24/25. As of the end of June, the balance of this type of loan was 160 million pounds, an increase of 130 million from June 2024 - even if £50 million was repaid during the period.

TA disclosed in August that Manchester United may once again use revolving credit to support more than £200 million in recruitment spending this summer. A new mortgage registration appeared on July 10 with Bank of America as the beneficiary of the existing credit line. Whether the debt exceeds £637 million at the end of June will be subject to the disclosure of the full annual report.

Despite six consecutive years of losses, after excluding the dismissal of special projects such as Tenhach and Ashworth, operating losses have narrowed from £60 million to 30 million, and wage expenditure has also dropped to a five-year minimum, indicating that cost control measures are taking effect.

However, the 25/26 season is expected to be the fourth consecutive year that Manchester United's revenue hovers in the range of 640 million to 670 million pounds, while competitors are still growing, debts have risen instead of falling, and Old Trafford's road to revival remains a long way to go.