Join and reorganize and reorganize the core competitiveness, Hong Jiatong leads the silicone system to transform and create a "new joint force"

In the past year, under the guidance of Hong Jiatong, Silicon has started many mergers and purchases. Silicon is rapidly changing through a series of restructuring of capital structures and business content. This year will be the key year for Silicon to turn profitable.

King Hong Jia-Tong, chairman of the board of directors and strategy directors of Silicon in 2023, has undergone significant changes in Silicon's business content under his financial operations.

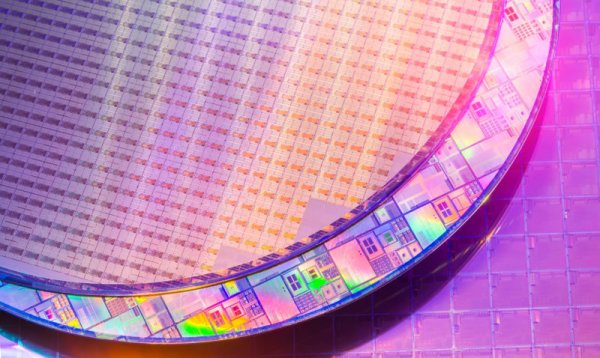

According to the report of the "Financial News" double-week issue, before 2023, the main products of Silicon will be the design of touch chips and MEMS Microphone chips. From 2017 to 2022, Silicon's revenue was between 250 million and 180 million yuan. The company mainly relies on joint dividends to make profits, but it still handed over a concessional performance list in four years.

After Hong Jiachang took over, he began to carry out a series of transformations of the silicon system. First, it was announced in February last year that Silicon's capital reduction was 2.6 billion yuan, with a reduction of 35%. Then, in April last year, Silicon announced that it would acquire 100% of Shandong Union's shares from Hefeng, a subsidiary of Kaiman's subsidiary in China, for approximately NT$350 million. What Unit does is IC design service business, and Taiwan media also uses the "second Zhiyuan" to describe the status of Unit in the United Group.

However, in August, Silicon increased its capital by another 270 million yuan, using stock exchange, without using cash to acquire 100% of its shares in IC design company Huakang. What Kang did was a battery management chip and a hybrid microcontroller chip. Before the merger, Kang handed over the profits in five of the six years.

Hong Jiatong's merger plan is still being promoted quickly. In April this year, Silicon Corporation once again purchased Lingyang Huaxin through joint operations. The outside world was curious why Silicon Corporation bought Lingyang Huaxin? In response to this, Hong Jiatong said that Lingyang Xin used to invest in Lingyang to make driving chips. "The R&D team has very experienced, and the entire investment amount is about 300 million yuan."

He said that because it was very troublesome to make money from Shandong to transfer back to Taiwan, Silicon not only took out 150 million RMB in cash, but also borrowed 140 million RMB from the bank. Since the profits of the Union are stable, this loan will be compensated with the Union's cash flow in the future. The Union's dividends do not need to be transferred back to Taiwan, and they can also save taxes. In a sentence, this approach minimizes the impact of merger cash on silicon.

Silicon has also begun to reduce its shareholding in part of its transfer investment. For example, Huitong Zhilian, which is a business in the Internet, originally held a 51% stake, but it has quietly dropped to 37% last year. This company was also the company with the most investments in silicon last year, with more than 50 million yuan last year.

The Financial News pointed out that after a series of integrations, the "New Joint Army" that incorporated into the Silicon Corporation will naturally regard Joint as the main crystalline foundry factory, and at the same time also contribute to the parent company's acquisition. Therefore, in the first quarter of this year, the single quarterly investment of Silicon Corporation reached 470 million yuan, a 12-fold increase from 34 million yuan in the same period last year, and the gross profit margin reached 44%, better than the 21% level in the same period last year. The net loss was 15 million yuan, a sharp drop from 81 million yuan in the same period last year.

Benefits from operation, the merger and the effectiveness of the integration is emergingAccording to industry insiders, Silicon's growth momentum in the past year mainly comes from Huangkang. Before Huangkang joined the Silicon Corporation, the two companies merged and acquired the IC design rankings in Taiwan by about 50. Now the efficiency is gradually emerging, and the ranking has improved to 50th in the first half of this year.

In the future, if the investment in Lingyang Huaxin is approved by the investment review, it will cause equity inflation. Hong Jiatong's plan is that if Lingyang Huaxin's operating income and cash flow continue to develop positively in the future, Silicon may reduce its capital in the future.

Since the current capital of silicon is still as high as 5.1 billion yuan, the capital revenue last year was only 73 billion yuan, just like a child wearing adult clothes. Although the investment has increased rapidly, the equity capital is too large and the improvement in profitability cannot be clearly reflected in the financial report.

Industry insiders revealed that Silicon is continuing to look for purchases, "they will avoid the price-killing Red Sea market, and look for IC design companies that are truly niche, market share, and can continue to upgrade in the future, but they will not consider companies that are too big." Silicon will adjust its equity on the one hand, and find acquisition targets on the other hand, and create a new batch of joint forces.

However, the outside world is also discussing that both Youzhihara and United, under the IC design services, are engaged in IC design services. In terms of internal resource allocation, how to achieve a balance in the future? It will be another observation point.

Silicon is a key battle for the Chairman of the Electronics Corporation, Hong Jiatong, who once said that he now "looks very closely on Silicon's money." Hong Jiatong is reorganizing the resources of the Joint Group. Silicon is currently close to the two-square-month increase. In the next few quarters, it will be the key period for the Silicon to turn profitable.

Extended reading: The US-Japan Trade Agreement was decided! Why did Japan's taxes cut from 25% to 15%? The car stocks are still rising. 3 major points are viewed at one time The national bills need to be increased again. One paper has a paper of password test for the major shareholders. Mutual trust The misunderstanding of "Basic Agreement" contains the suggestion of improving trade deficit. Gu Chaoming broke the myth: the US dollar is the root of the problem